Uber Technologies Inc. recently unveiled its financial results for the fourth quarter, demonstrating a complex interplay of strong revenue growth and cautious guidance that elicited a notable market reaction. Shares fell around 7% in premarket trading, reflecting investor skepticism regarding the company’s outlook despite beating revenue expectations. This article dissects Uber’s financial highlights, explores various segments of its business, and assesses the implications of its strategic moves moving forward.

Uber reported a revenue of $11.96 billion for the fourth quarter, which surpassed the analyst expectations of $11.77 billion. This figure marked a significant year-over-year increase of 20%, up from $9.9 billion a year prior. However, despite the promising revenue figures, the future projections offered by Uber were underwhelming, with expectations for gross bookings in the first quarter falling short of market predictions. The anticipated gross bookings were set between $42 billion to $43.5 billion, while analysts had estimated around $43.51 billion. This disparity indicates a potential slowing momentum that has caused market concern.

Additionally, Uber reported a notable net income of $6.9 billion—or $3.21 per share—up from $1.4 billion or 66 cents per share in the fourth quarter of the previous year. Crucially, part of this increase in net income was attributed to a $6.4 billion benefit from a tax valuation release and a $556 million pre-tax benefit from gains in equity investments. Such non-operational boosts raise questions regarding the sustainability of net income growth without these one-time items.

A closer examination of Uber’s business segments reveals varying degrees of success. The Mobility segment led the way, with gross bookings reaching $22.8 billion—an 18% increase year-over-year. Revenue from this segment was reported at $6.91 billion, exceeding expectations of $6.77 billion. The Delivery segment, too, displayed robust performance with gross bookings of $20.1 billion, yielding $3.77 billion in revenue, above the anticipated $3.66 billion.

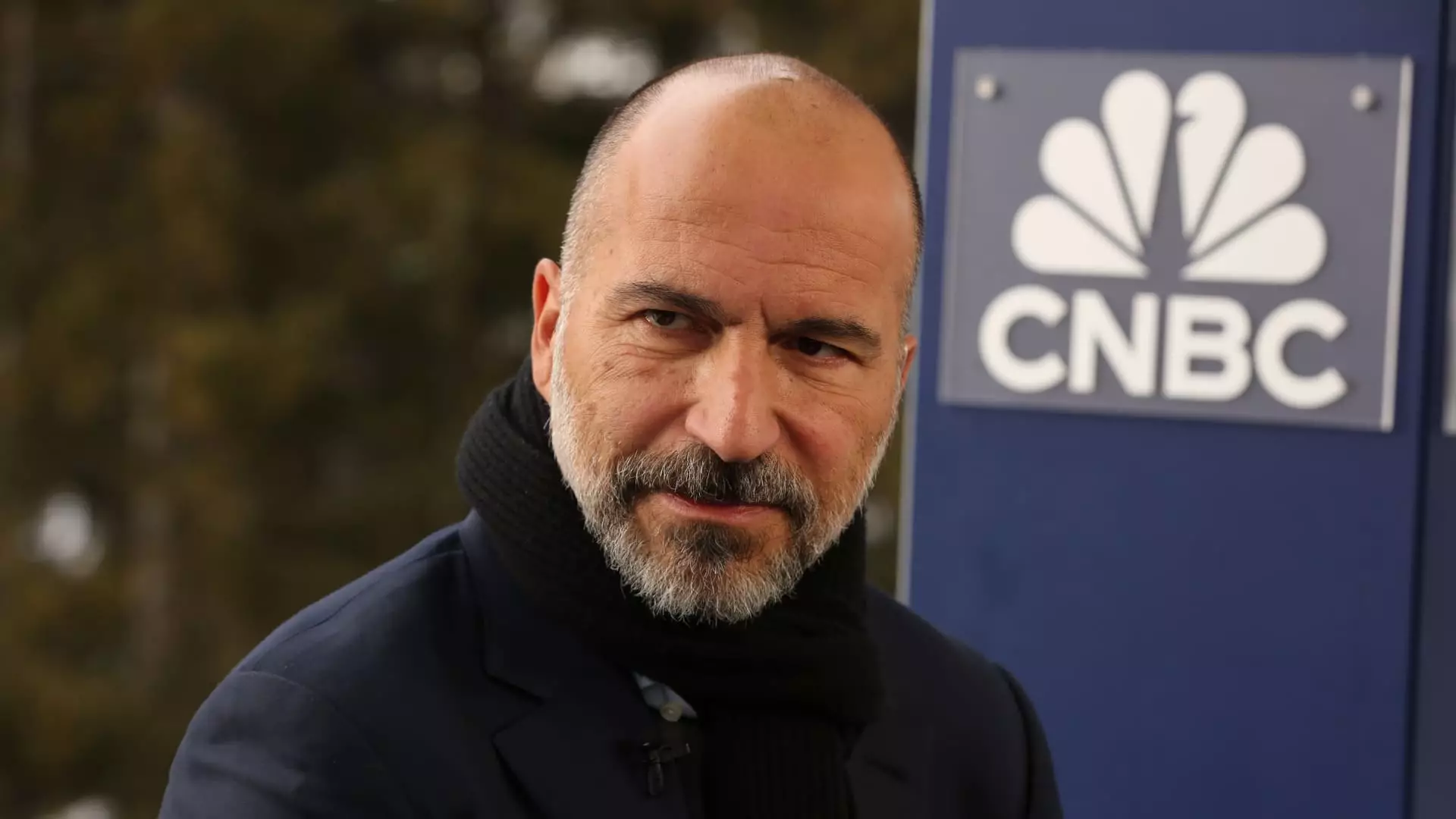

Conversely, Uber’s Freight business exhibited stagnation, generating $1.28 billion in revenue, exactly matching the previous year’s figure but missing analysts’ expectations of $1.31 billion. CEO Dara Khosrowshahi has referenced the increasing challenges within the freight sector, emphasizing a paradigm shift in consumer spending habits post-pandemic, where more individuals are opting for services over goods.

In conjunction with its financial results, Uber announced a significant advancement in its strategic roadmap: a public launch of robotaxi services in Austin, Texas, in collaboration with Waymo, a subsidiary of Alphabet Inc. This initiative signals Uber’s commitment to innovating in the autonomous vehicle sector, potentially paving the way for transformative developments in the ride-sharing landscape.

The launch invites Austin residents to join an “interest list” via the Uber app, aiming to facilitate pairing with Waymo’s driverless vehicles. This initiative not only showcases Uber’s innovation but also emphasizes the importance of partnerships and technological advancements in maintaining a competitive edge in a rapidly evolving industry.

Despite the impressive revenue and income figures, the market’s response indicates a cautious sentiment from investors. The stark contrast between strong current performance and the conservative guidance for the upcoming quarter showcases a fundamental uncertainty regarding Uber’s future growth trajectory. The critical question remains: Can Uber sustain its momentum in a challenging economic environment characterized by fierce competition and shifting consumer preferences?

Moreover, while the company boasts impressive figures like completing 3.1 billion trips and reaching 171 million monthly active users, potential investors must consider whether these statistics translate into long-term profitability in the face of new threats—including evolving mobility competitors and regulatory challenges in various jurisdictions.

While Uber has undoubtedly displayed strength in its recent quarterly performance, the mixed signals regarding future growth potential underline the need for careful evaluation by investors. As the company embarks on innovative paths such as autonomous vehicle services, it must also navigate the uncertain market conditions and prepare for continued demographic and economic shifts that will impact its various business segments in the coming years.