In recent times, TikTok has been at the epicenter of a myriad of controversies and challenges, particularly in the U.S. and Canada. While the platform grapples with regulatory scrutiny and potential bans, it appears intent on capitalizing on new growth opportunities elsewhere. The impending launch of TikTok Shop in Mexico marks a pivotal moment in the platform’s broader strategy to engage with Latin American markets and foster the in-stream shopping model that has seen tremendous success in its Chinese counterpart, Douyin.

Latin America is increasingly becoming an attractive frontier for TikTok. The vibrant and diverse consumer base holds untapped potential for digital commerce. With traditional retail channels disrupted by the COVID-19 pandemic, consumers have swiftly shifted towards online shopping. This environment presents an optimal setting for TikTok to introduce its shopping features. By establishing TikTok Shop in Mexico, the company aims to cultivate a new wave of shopping behaviors that could ultimately replicate the successes seen in China, where Douyin has transformed e-commerce into a mainstream activity.

Moreover, TikTok’s focus on Mexico is strategic. The country serves as a gateway to broader Latin American engagement. By laying down roots in Mexico, TikTok signals its intention to explore not just immediate financial gains but also long-term market viability across the region. TikTok’s approach, including waiving commission fees for the first 90 days for registered merchants, showcases a commitment to support local businesses and incentivize engagement on the platform.

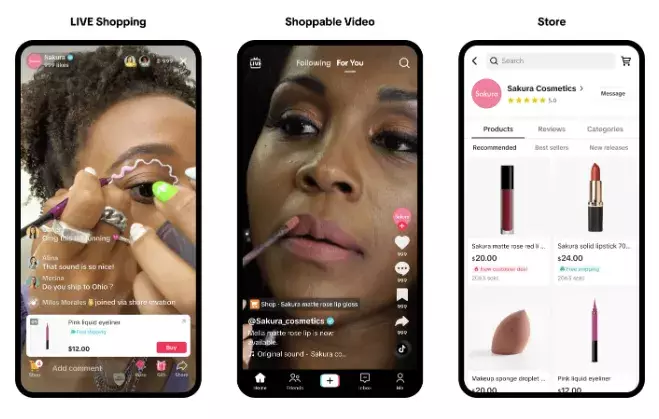

TikTok has been closely observing Douyin’s meteoric rise in the Chinese market, where the app generated around $500 billion in sales last year. This success is often attributed to the integration of social media and e-commerce, allowing users to discover products through engaging content. The synergy between entertainment and shopping has redefined consumer behavior, moving it beyond traditional advertising toward interactive purchasing experiences.

In contrast, TikTok’s sales in 2023 were significantly lower, estimated at around $4 billion. This disparity highlights the challenge TikTok faces in converting its massive user base into active shoppers in Western markets. However, recent data reveals a 3x increase in sales during events like Black Friday. This suggests a growing, albeit still nascent, interest in in-stream shopping in Western contexts.

In particular, regions like Southeast Asia have shown substantial engagement with TikTok’s shopping features. This growing adoption indicates an opportunity for TikTok to replicate this interest in other emerging markets, especially in Latin America. The company’s hopes to create a thriving shopping ecosystem in Mexico could potentially mirror the patterns observed elsewhere.

Despite the potential for expansion, TikTok’s future in the U.S. remains precarious. With ongoing discussions about its operational structure, including a potential co-ownership arrangement with U.S. investors, the road ahead is fraught with uncertainty. As the possibility of a ban looms, TikTok’s urgency to strengthen its presence in other markets becomes increasingly clear.

Currently, TikTok’s operational framework in the U.S. is under intense scrutiny, particularly in light of the “Protecting Americans from Foreign Adversary Controlled Applications Act.” These regulatory concerns highlight the platform’s vulnerabilities and the pressing need for alternative revenue streams. As TikTok navigates these challenges, its Latin American strategy serves to diversify its market presence and reduce reliance on the volatile U.S. landscape.

While the launch of TikTok Shop in Mexico represents an optimistic step forward, there are limitations to consider. The platform will impose restrictions on the sale of certain categories of goods, such as jewelry and healthcare products, indicating an awareness of potential market pitfalls. This cautious approach balances ambition with the necessity of adhering to local regulations and consumer demands.

TikTok’s expansion into Latin America, particularly through its shop functionality, underscores a critical juncture in the company’s growth strategy. While facing substantial domestic challenges, its efforts to tap into emerging markets demonstrate the platform’s resilience and adaptability. The coming months will reveal whether this strategy can not only fortify TikTok’s international presence but also inform its future direction as it seeks to navigate a complex landscape of regulation and competition.