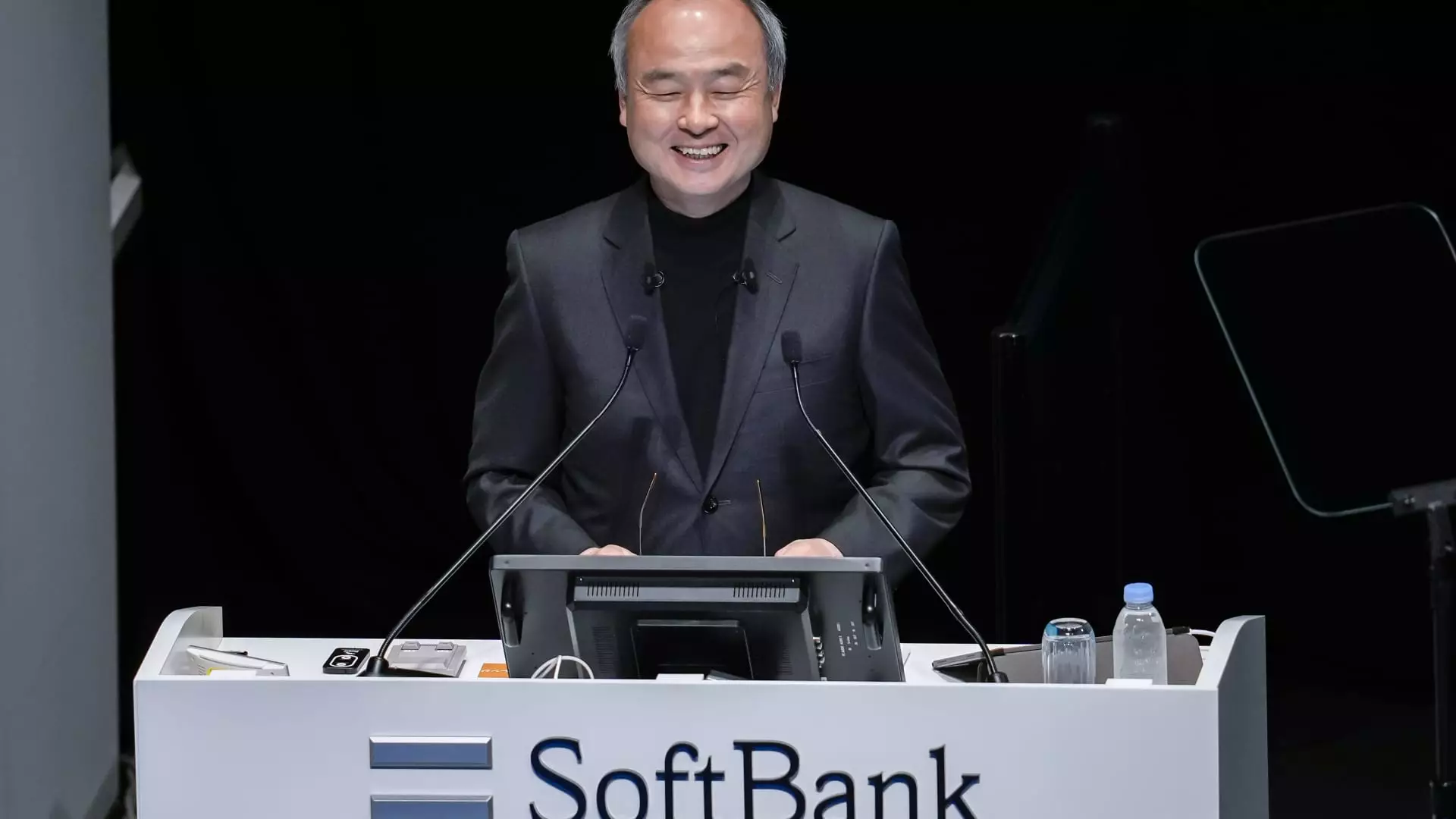

SoftBank’s CEO Masayoshi Son is making one of the most audacious bets in the technology sector: an unwavering commitment to OpenAI, an unlisted and unprofitable company, with investments now approaching $33 billion. While many investors lean toward startups with clear financial trajectories or established market dominance, Son’s conviction rests on OpenAI’s potential to lead the world into an era of “artificial superintelligence” (ASI)—AI that surpasses human intelligence by leaps and bounds. This isn’t a cautious investment; it’s a bold declaration that SoftBank wants to become the nucleus of an entire technological revolution. Unlike the typical approach, Son’s vision is about playing the long game and shaping an entirely new domain of industry and innovation.

From Missed Opportunities to Steadfast Determination

Interestingly, Son’s commitment to OpenAI is not a recent development but one born from a near-miss. Before 2019, OpenAI’s CEO Sam Altman approached Son for a $10 billion investment. Son, flush with capital from the success of the Vision Fund, was ready to say yes. Yet, OpenAI eventually partnered with Microsoft, which secured exclusive computing rights. In hindsight, Son believes this was a strategic misstep for OpenAI and hints that SoftBank might have been a better long-term partner, despite its smaller size at the time. This reflection sheds light on how business relationships are often shaped not solely by money but by strategic fit and timing. Remarkably, instead of retreating, SoftBank doubled down, intensifying its investments and involvement, signaling perseverance that many large conglomerates lack.

Challenging Industry Giants: The Microsoft Factor

Microsoft’s exclusive relationship with OpenAI in the early days seemed like a natural alliance, given Microsoft’s vast computing infrastructure and global presence. However, this exclusivity ended this year amid reports of disagreement over OpenAI’s pivot toward a for-profit model, a plan Microsoft has reportedly not approved. This rift places SoftBank in a curious position: no longer simply an investor, it’s potentially a key ally providing alternatives to Microsoft’s cloud dominance. SoftBank’s willingness to proceed regardless of Microsoft’s stance shows a fearlessness in navigating the complex politics of tech alliances—a recognition that progress sometimes requires breaking away from dominant players. It also illustrates that deep-pocketed tech conglomerates may not always have the best strategy for nurturing breakthrough innovation.

Artificial Superintelligence: A Ambitious, Controversial Frontier

Son’s vision extends beyond AI as we know it today. He envisages an “artificial superintelligence” ten thousand times smarter than humans, a speculative yet thrilling concept. SoftBank’s role is not just a shareholder; Son wants the company to be the “organizer of the industry” in the ASI age. This ambition involves leveraging SoftBank’s acquisition of Arm—the British semiconductor company—and recent investments in chip designers like Ampere, shaping a vertically integrated ecosystem that can support the computational demands of ASI. While the concept of ASI is still theoretical and fraught with ethical, security, and existential questions, Son’s unequivocal pursuit could accelerate research, ignite competition, and potentially place SoftBank at the head of a revolutionary wave. This is a gamble not just on technology but on the future societal structure itself.

Risk, Reward, and an Unconventional Path Forward

What makes SoftBank’s approach stand out is its blatant disregard for short-term profitability. Investing billions into a company that remains unlisted and unprofitable flies in the face of traditional corporate prudence. Yet Son’s philosophy appears rooted in visionary entrepreneurship — believing that today’s losses are tomorrow’s disruptive victories. He is not deterred by market skepticism or OpenAI’s financial opacity; rather, he views this as the cost of pioneering an emergent paradigm. The ambition to establish a $1 trillion industrial complex in the U.S. further underscores SoftBank’s plan to embed itself deeply in the next technological frontier. While such risks could lead to spectacular failure, history shows that grand technological leaps often require such seemingly reckless resolve.

Final Thoughts: The Courage to Dream Big in a Time of Caution

In an age when many corporations are cautious and risk-averse, SoftBank’s posture is a compelling counter-narrative—a story about vision, tenacity, and bold leadership. Masayoshi Son isn’t just following the trend of artificial intelligence investment; he’s attempting to redefine the future of human-machine interaction by betting everything on the idea that ASI will reshape the world in unimaginable ways. Whether this vision will bear fruit remains uncertain, but it undeniably demands respect. SoftBank’s saga teaches us that transformative innovation rarely comes from playing it safe—it requires the courage to commit wholeheartedly to a future others may not yet fully understand.