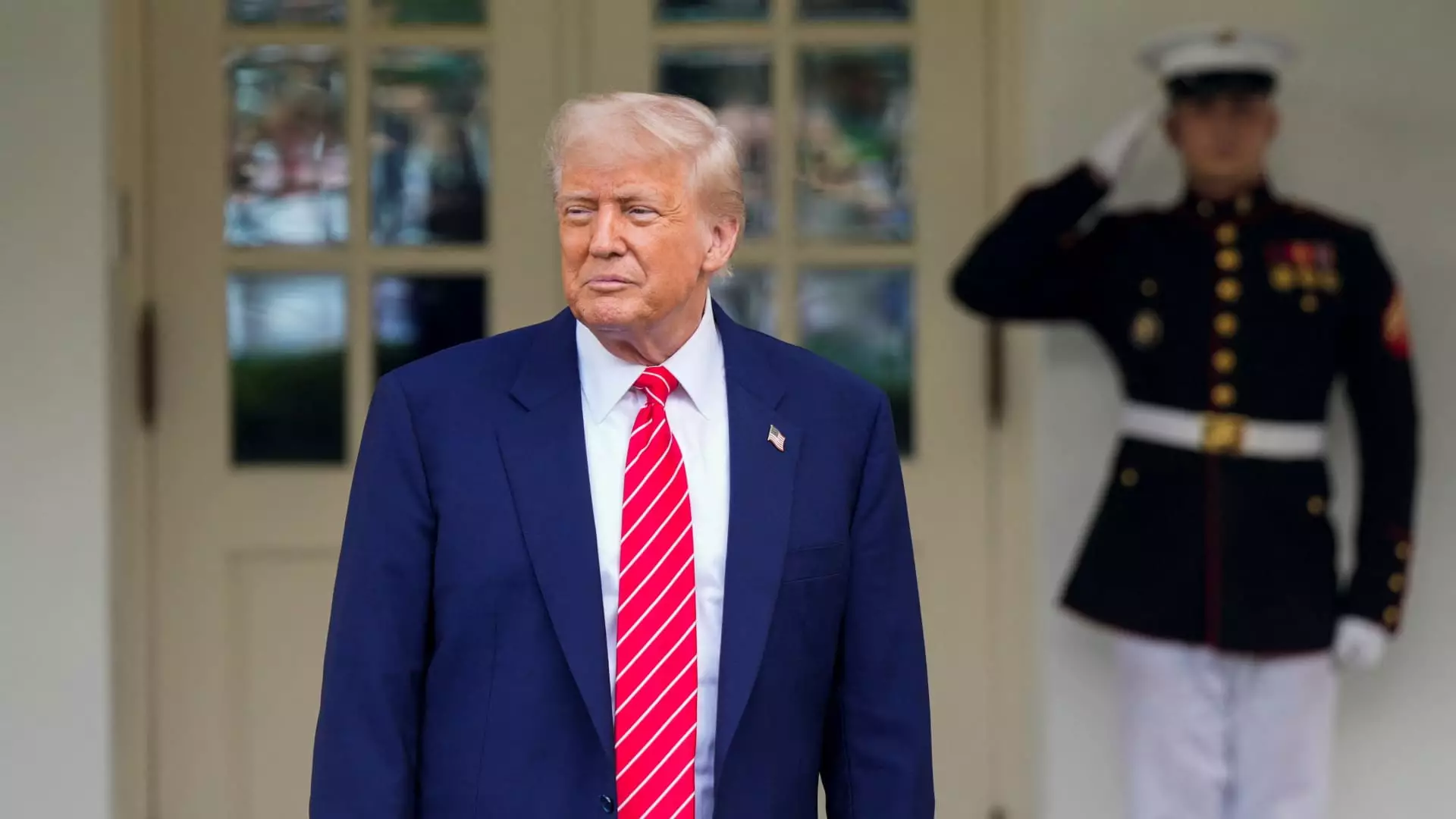

The turbulent landscape of cryptocurrency regulation in the United States highlights a significant roadblock—one that stems from the unique position of President Donald Trump and his personal financial interests in the digital currency space. As the tumultuous events around the failed GENIUS Act unfold, it becomes clear that when personal profit blurs with public policy, the implications can be dire, both for investors and the development of comprehensive laws in a rapidly evolving market.

The GENIUS Act aimed to create an overarching framework for stablecoins—digital currencies meant to mirror the value of fiat currencies like the U.S. dollar—by introducing federal regulations. However, its failure to advance through the Senate was attributed to concerns over President Trump’s potential conflicts of interest, specifically related to his personal cryptocurrency ventures. Senators like Jeff Merkley voiced strong objections, equating the situation to a scheme that compromises national interests and public trust. Such assertions raise critical questions about the ethical boundaries that should govern the intersection of personal endeavors and legislative responsibilities.

A Bipartisan Bill Encumbered by Partisanship

While the failure of the GENIUS Act seemed momentarily surprising given the bipartisan potential it had, insistence from Senators on the need for more robust regulatory measures underlined a deeper division. A contingent of Senate Democrats, some of whom previously supported the bill, reversed course, citing unresolved issues regarding anti-money laundering protocols and national security risks surrounding foreign actors in the cryptocurrency market.

What is particularly alarming is not just the non-passage of legislation but what it represents: an extraordinary stasis in governance brought about by conflicts involving a sitting president. Critics, including prominent Democrats, pointed fingers at Trump’s entrepreneurial ventures, such as his meme coin, $TRUMP, which tied directly into his financial gains and raised ethical questions about leveraging political office for social influence and personal enrichment. The intertwining of celebrity and policy complicates essential governance where rigorous oversight is desperately needed.

The Broader Cryptocurrency Ecosystem at Stake

The standoff over cryptocurrency regulation illustrates a broader dilemma within the cryptocurrency community. The momentum for innovation and development often clashes with structural impediments rooted in political conflicts. Entrepreneurs in the crypto space express frustration, insisting that avenues for necessary legislative change are being stymied by the personal financial agendas of political figures. Ryan Gilbert, a fintech entrepreneur, articulated a common sentiment when he decried the continuation of personal business interests interfering with progressive policy-making.

The burdens this situation places on innovation cannot be overstated. A robust, well-regulated crypto market can propel technological advancements, positioning the U.S. as a leader in the global industry. However, the associations brought forth by Trump’s ventures overshadow the significant potential benefits that sound legislation could offer. Critics argue that the current environment is detrimental not just to potential investors but to the broader legitimacy of the U.S. cryptocurrency sector in international markets.

Calls for Accountability and Ethical Governance

With trust in political institutions already shaky, the intertwining of Trump’s financial pursuits with legislative action has energized calls for heightened accountability. The introduction of proposed measures like the “End Crypto Corruption Act” signals a recognition of the need for stringent conflict-of-interest laws that curtail such entanglements. Politicians are beginning to grasp that regulations are not merely a bureaucratic hurdle but a necessary foundation for a sustainable industry that can attract investment.

Senator Elizabeth Warren and others have put pressure on Congress to act decisively against potential malfeasance linked to Trump’s crypto enterprises, emphasizing the need for transparency and an absence of self-dealing behaviors among elected officials. As financial interests intertwine with public duties, so too does the integrity of American democracy hang in the balance.

The Implications for Future Legislative Efforts

The debacle over the GENIUS Act elucidates how deeply entrenched conflicts can hinder progress on legislation crucial for economic growth and consumer protection. As the cryptocurrency landscape becomes increasingly complex, the stakes grow higher for maintaining trust and encouraging innovation.

For those looking to secure their foothold in the burgeoning crypto economy, it is imperative that lawmakers transcend these conflicts of interest to develop a cohesive regulatory environment. The ramifications of neglecting this responsibility could tarnish not only the reputation of U.S. governance but also its standing in the fast-evolving global financial ecosystem. In a time when digital innovation is paramount, the interplay of personal motives and public policy continues to pose a challenge that cannot be ignored.