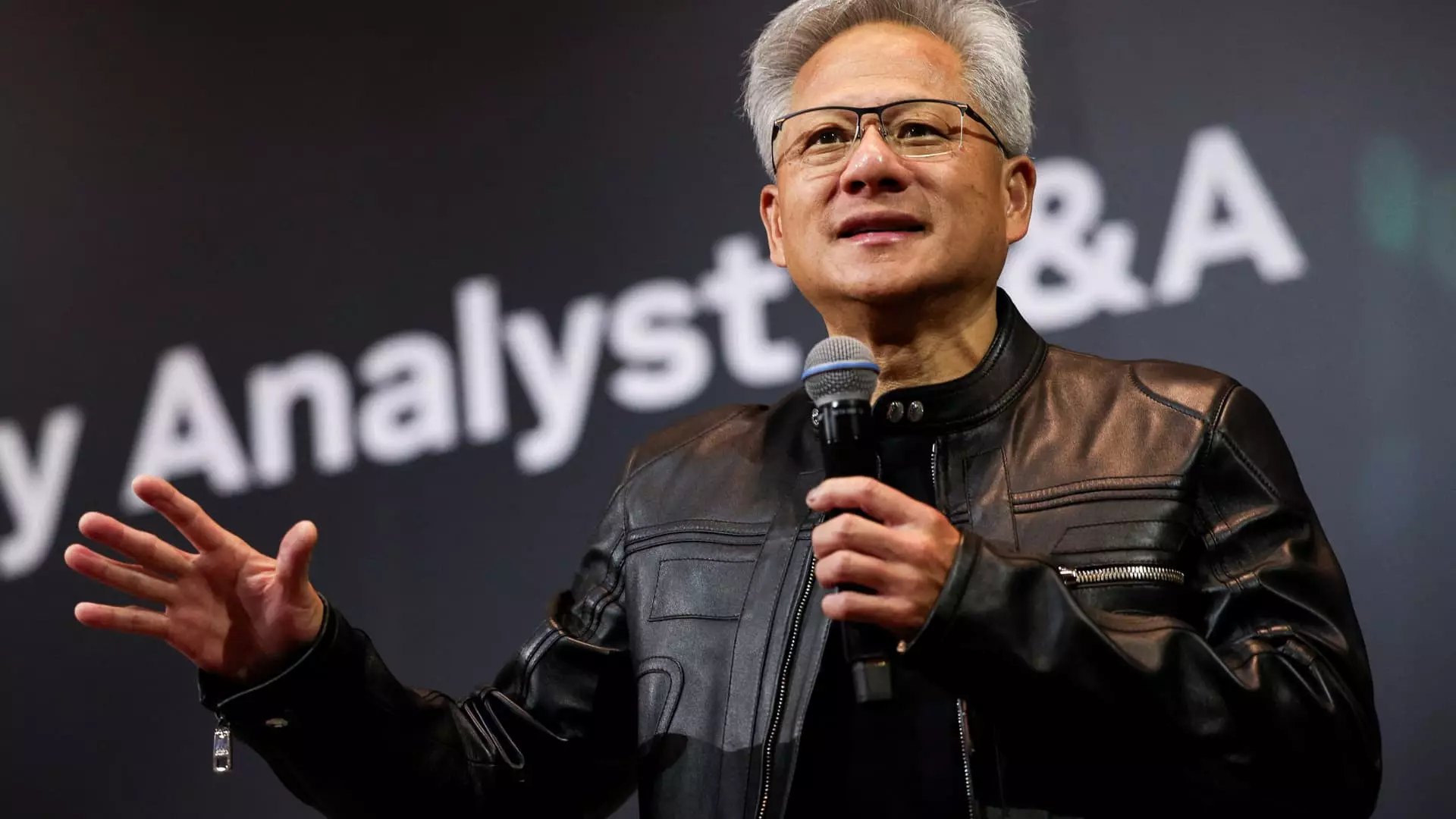

In an era defined by technological upheaval and geopolitical tensions, the recognition of Taiwan Semiconductor Manufacturing Co. (TSMC) by Nvidia’s CEO Jensen Huang signals a crucial reality: the semiconductor industry is no longer merely about chip fabrication but has become a geopolitical battleground and a strategic cornerstone of global innovation. Huang’s unabashed praise—calling TSMC “one of the greatest companies in the history of humanity”—reflects a deep understanding of TSMC’s unparalleled role in shaping future tech landscapes.

This outspoken endorsement isn’t just corporate cheerleading; it’s a calculated affirmation of TSMC’s unique position in the semiconductor ecosystem. As the sole manufacturer capable of producing cutting-edge chips at scale, TSMC stands at the nexus of innovation and geopolitical influence. With Huang urging investors to consider the company’s stock as “very smart,” he effectively elevates TSMC from a mere supplier to a strategic partner whose success is intertwined with the future of AI, cloud computing, and advanced electronics. This perspective challenges the narrative that semiconductor production is solely a technological challenge—it’s a political and economic asset where control equates to power.

Huang’s remarks also function as a subtle rebuke of the shifting landscape where U.S. policy and Chinese security concerns threaten to fragment global supply chains. His emphasis on TSMC’s contributions—such as producing six new products for Nvidia, including state-of-the-art CPUs and GPUs—underscores the company’s technological prowess. In an industry where innovation is measured in nanometers and high-frequency processing, TSMC’s strategic investments solidify its critical role in nurturing the next generation of AI hardware, positioning the company as both a technological leader and a geopolitical pawn.

Strategic Alliances and Global Power Play

The timing of Huang’s assertions coincides with mounting speculation about U.S. efforts to secure stakes in key global tech firms, especially those benefiting from the CHIPS Act. Washington’s push to bolster domestic chip manufacturing via subsidies and potential equity stakes reflects an aggressive attempt to curb China’s influence, expand U.S. technological sovereignty, and maintain global supremacy. The government’s interest in acquiring part-ownership of companies like TSMC signals a paradigm shift: semiconductor manufacturing is no longer purely economic but a national security priority.

Huang’s appreciation for TSMC’s role in U.S.-based manufacturing—such as its announced $6.6 billion investment in Arizona to establish advanced fabrication plants—serves as a strategic endorsement of multilateral collaboration. This not only reassures U.S. policymakers of TSMC’s commitment but underscores the company’s savvy navigation of geopolitical currents. TSMC, by expanding its physical footprint in the U.S., aligns itself with a broader vision of supply chain resilience, even as tensions between Washington and Beijing escalate.

Yet, Huang is also aware of the delicate balance. His acknowledgment of ongoing issues with China regarding Nvidia’s H20 chips—after Beijing raised security concerns and temporarily suspended component orders—illustrates the tightrope TSMC must walk. The company’s efforts to address China’s concerns demonstrate a pragmatic approach to maintaining its international presence amid geopolitical headwinds.

The Future is Taiwan: Growth, Innovation, and Challenges

Huang’s announcement of Nvidia’s intent to establish a new office in Taiwan—“NVIDIA Constellation”—marks a clear acknowledgment of Taiwan’s vital importance in the global semiconductor supply chain. The emphasis on growing the Taiwanese workforce highlights the region’s status not only as a manufacturing hub but as a hotbed of talent fueling innovation. This move is not just about expanding workplace capacity but strategically positioning Nvidia to leverage Taiwan’s robust tech ecosystem.

The company’s deep integration into Taiwan’s local industry underscores a profound dependence that benefits both Nvidia and TSMC. The collaborative efforts with local chipmakers, system vendors, and engineers reinforce a symbiotic relationship that is crucial for Nvidia’s AI ambitions. Huang’s confidence in resolving residual issues with Taiwanese authorities signals a long-term commitment to this regional nexus of innovation.

Ironically, even as Nvidia and TSMC pedal forward with expansion plans, the global semiconductor landscape remains precarious. The recent pause on some chip exports to China, due to security concerns over Nvidia’s H20 GPUs, exposes vulnerabilities in a tightly interconnected supply chain. While companies like Foxconn are caught in geopolitical crossfire, TSMC’s ability to navigate these complexities will define its future resilience.

Without a doubt, Huang’s strategic praise for TSMC is not naive optimism but a bold declaration of confidence in a company and region that wield immense influence over the global technology trajectory. As the world’s digital economy grows more intertwined with geopolitics, Taiwan’s semiconductor industry emerges as a pivotal battleground—and Huang is positioning Nvidia firmly on the winning side of this high-stakes game.