As Nvidia gears up to release its fourth-quarter earnings report, expectations from Wall Street are sky-high. According to LSEG consensus estimates, analysts predict an adjusted EPS of $0.84 alongside a revenue figure that could reach an impressive $38.04 billion. This pivotal earnings report, set to go live on Wednesday, marks the conclusion of what can be regarded as one of the most transformative years for any sizable technology corporation. Analysts project a staggering 72% revenue growth for the quarter ending in January, adding to a broader fiscal yearly expectation that is set to see revenues surpass the $130 billion mark, more than doubling from the previous year.

This remarkable growth can be attributed to Nvidia’s position at the forefront of the artificial intelligence revolution. The company’s graphics processing units (GPUs) have become integral to building and deploying AI applications, including transformative platforms like OpenAI’s ChatGPT. With Nvidia’s stock surging more than 440% over the past two years, its market capitalization has fluctuated around a colossal $3 trillion, making it the most valuable company in the United States at times. However, the gains have shown signs of plateauing recently, as Nvidia finds itself trading at similar prices to one year ago.

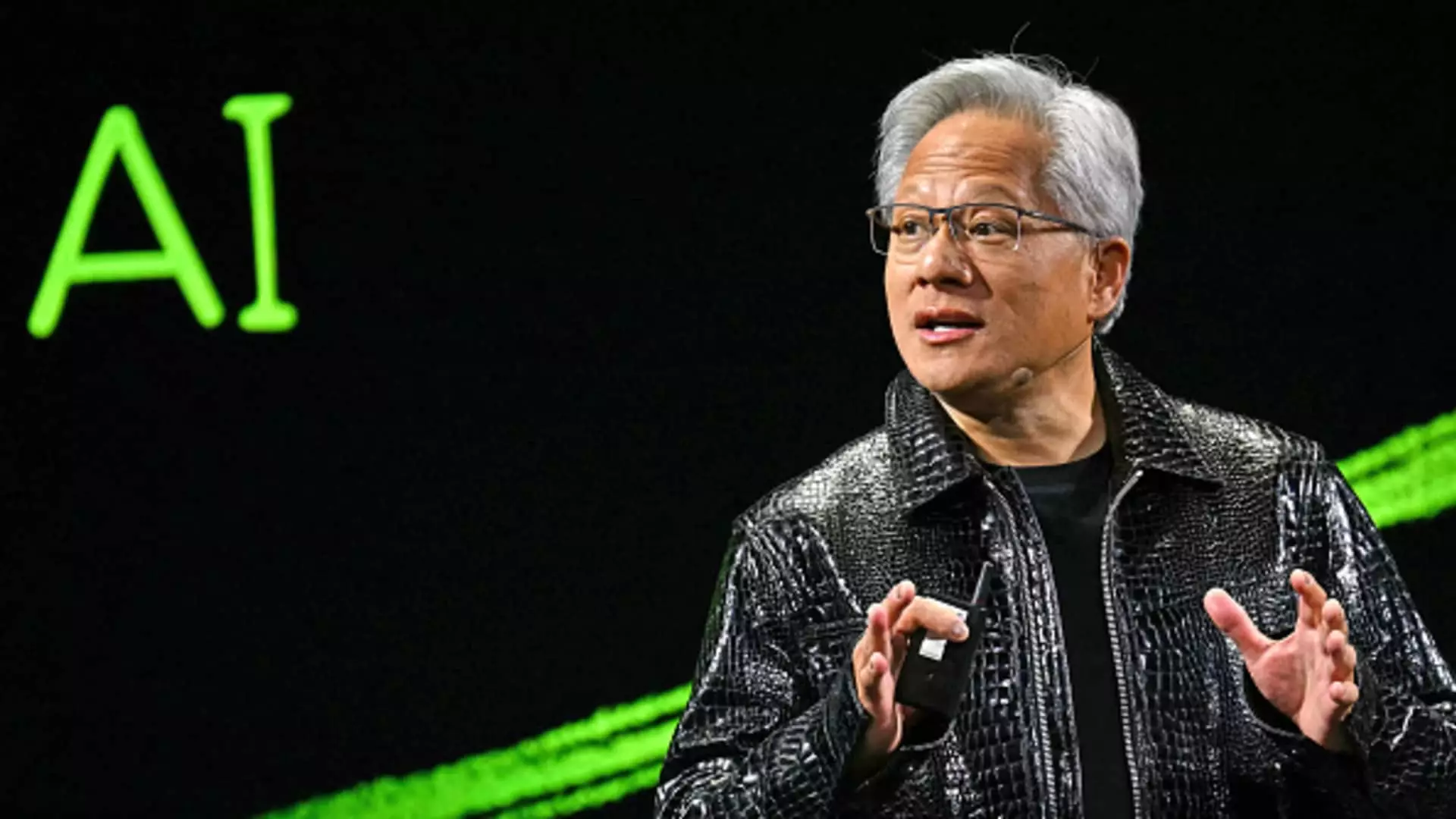

As Nvidia prepares to release these critical financials, investors are becoming increasingly inquisitive about the company’s sustainability and future growth trajectory. Nvidia’s CEO Jensen Huang will take the stage to address these concerns, especially regarding the AI growth landscape two years into its ascendancy. Investors are wary of potential pullbacks from hyperscale cloud providers, Nvidia’s key clients, who may be implementing cost-cutting measures in a post-expansion climate. Recent developments, particularly the emergence of DeepSeek’s R1 chip from China, have added a layer of complexity by suggesting that smarter AI systems may not rely as heavily on Nvidia’s chips as previously speculated. This has raised concerns over demand, and investors are closely scrutinizing any indicators of this need softening.

Moreover, the geopolitical implications of AI technology also linger in the backdrop. U.S. export regulations on Nvidia’s advanced AI chips to China, already stringent, could tighten further in light of national security concerns, jeopardizing potential revenue streams. Compounding these worries, there are doubts surrounding the rollout of Nvidia’s latest Blackwell AI chip, which has reportedly faced delays tied to thermal and yield challenges. Analysts at Morgan Stanley recently estimated that tech giants like Microsoft, Google, and Oracle will dominate spending on Blackwell, but uncertainty about the actual execution remains.

Microsoft’s role in Nvidia’s future is particularly noteworthy. Recent rumors suggest that Microsoft has adopted a more cautious approach, opting out of leases with private data center operators and altering negotiations around new ones. Such moves have stirred apprehensions about whether the explosive growth of AI infrastructure can maintain momentum in light of dwindling investments from its largest client. However, in an attempt to quell these fears, Microsoft announced that it still intends to invest a significant $80 billion into infrastructure in 2025.

In contrast, other major players such as Alphabet, Meta, and Amazon have publicized their ambitious capital expenditure plans, with targets reaching $75 billion, up to $65 billion, and $100 billion respectively. Morgan Stanley analyst Joseph Moore has echoed sentiments from industry insiders, asserting that while there may be longer lead time shifts in land acquisition, the demand for Nvidia GPUs from Microsoft remains robust. Ultimately, the analyst has positioned a price target of $152 for Nvidia stock, suggesting that there remains potential for growth.

As Nvidia prepares to disclose its latest earnings and forward guidance for fiscal 2026, investors will be keenly attentive to any insights that illuminate the company’s ongoing relationships with cloud providers and the expected sales growth following last year’s elevated performance. The implications of this earnings report could set the tone not just for Nvidia, but for the broader market echoing the demand for AI technology and services. With the future filled with both exciting possibilities and notable challenges, the coming days will reveal whether Nvidia’s growth story continues or if it finds itself at a crossroads, reassessing the paths ahead in an ever-evolving technological landscape.