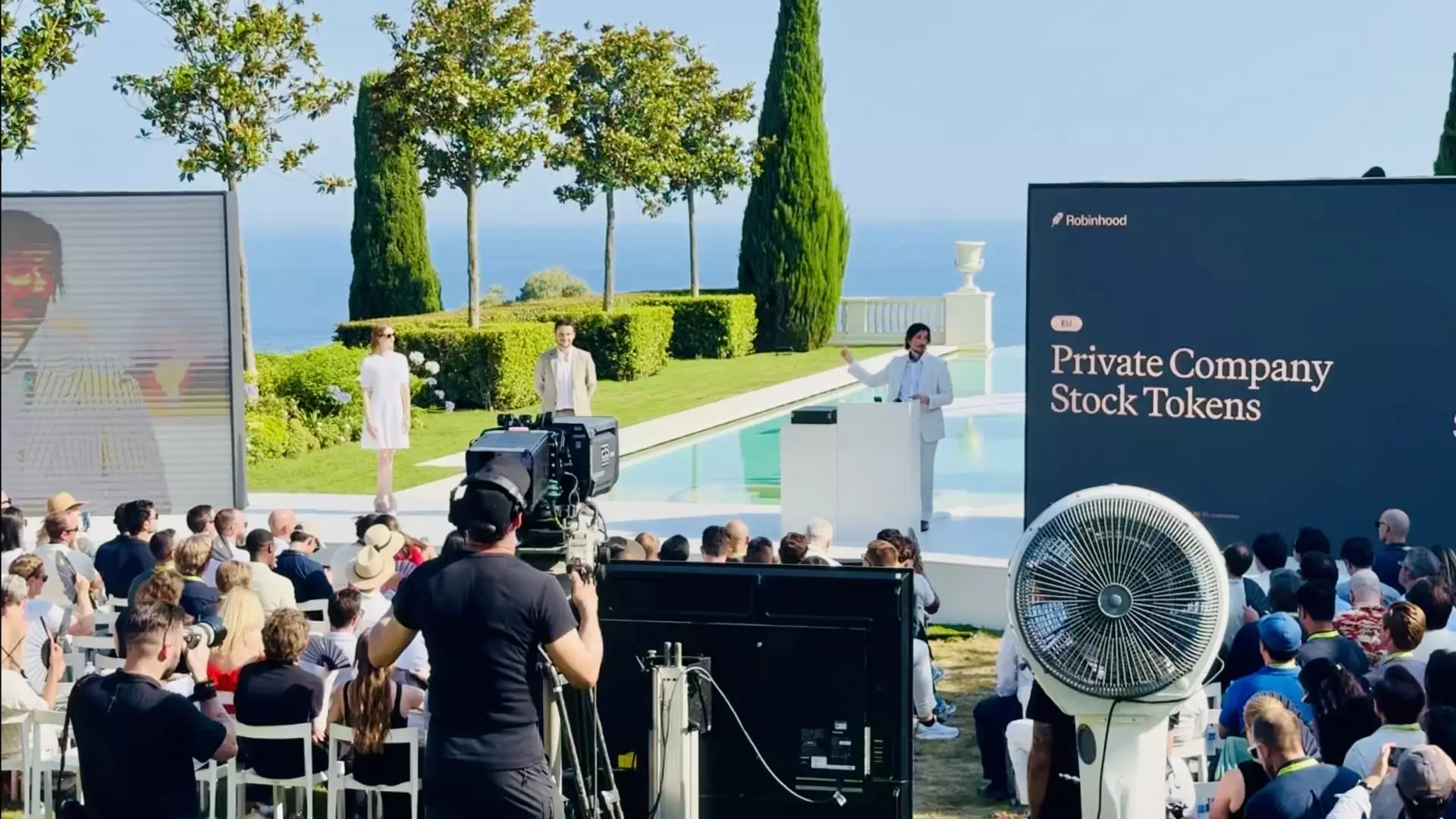

Robinhood’s recent announcement to tokenize shares of private giants OpenAI and SpaceX represents a landmark in the democratization of private equity. With these tokenized assets now accessible exclusively to European users on Robinhood’s crypto platform, the company is taking a definitive step toward dismantling the traditional gatekeeping mechanisms of private markets. Historically, private company shares like those of OpenAI and SpaceX have been severely restricted—available primarily to insiders or ultra-wealthy investors under stringent regulatory frameworks. By leveraging blockchain technology, Robinhood is not merely innovating on the product front; it is challenging the systemic inequalities embedded in financial markets.

This initiative is more than a typical rollout of a new feature; it signals a paradigm shift in how private equity can be perceived and accessed. Tokenization allows fractional ownership, enabling anyone with access to Robinhood’s European crypto app to trade these shares 24/5 without commissions or spread costs. Such openness has rarely been seen, especially in private equity, where liquidity is scarce, and investor eligibility is tightly controlled. Robinhood’s strategy here is clear: to utilize the EU’s more permissive regulatory environment as a springboard for experimentation in tokenized financial products, in hopes of eventually driving broader global adoption.

The Power and Potential of tokenization

Tokenization, the process of converting rights to an asset into a digital token on a blockchain, fundamentally redefines ownership and accessibility. Robinhood’s decision to tokenize private companies such as OpenAI and SpaceX is a masterstroke, not only because these companies are technology leaders with high investor demand, but also because this move brings liquidity and transparency to historically opaque asset classes. The novelty lies in the fact that tokenized shares can be traded around the clock, unlike traditional stock exchanges bound by limited trading hours, unlocking a new paradigm of market participation.

Furthermore, Robinhood’s giveaway of €5 worth of these tokens to onboard users is a tactical gesture signaling their conviction in the transformative power of tokenization. It’s both a marketing strategy and a means to distribute wealth to a broader demographic, effectively inviting users to “own a piece of the future.” This approach aligns with the company’s stated mission to combat financial inequality by offering inclusive access to exclusive investment opportunities.

Regulatory Challenges and U.S. Market Constraints

While this breakthrough is exciting, it’s important to scrutinize the hesitations and obstacles that remain, particularly in the U.S. market. The reason tokenized private shares are limited to EU users is largely regulatory. The U.S. enforces stricter rules, including the accredited investor requirement, which restricts participation in private market investments to a select subset of wealthy and institutional investors. Robinhood’s CEO, Vlad Tenev, has advocated for regulatory reform, highlighting blockchain’s potential to widen market participation. Yet, progress in America remains slow, and skeptical regulatory attitudes toward crypto-linked financial products persist.

In this light, Robinhood’s EU rollout feels like a deliberate leapfrog—testing, learning, and proving the model in a more receptive environment before attempting to influence U.S. regulators. While European users enjoy new forms of ownership, U.S. customers are still largely confined to traditional crypto offerings, albeit with some recent gains like the introduction of crypto staking on Ethereum and Solana, a product previously barred by the SEC.

Implications for the Future of Finance

Robinhood’s gamble is a fascinating intersection of technological ambition and socio-economic idealism. The company’s vocal commitment to closing the access gap is not just performative; it’s a real attempt to reshape financial ecosystems by expanding investment opportunities beyond the privileged few. The promise of blockchain-enabled private equity could generate meaningful shifts in wealth distribution if adopted widely and regulated thoughtfully.

However, this experiment’s success hinges heavily on continued regulatory evolution and user trust in tokenized assets. There are valid concerns around liquidity, valuation accuracy, and legal protections for token holders, which Robinhood and regulators alike must address. Still, the potential upside—the creation of a more inclusive, efficient, and transparent market—is too significant to ignore. Robinhood’s pioneering efforts may signal the dawn of a new investment era where access to the most innovative companies is no longer tethered to wealth or insider status, but rather to the power of open blockchain technology.