The venture capital landscape in the U.S. is poised for potential changes by 2025 as a significant number of unicorn startups—companies valued at $1 billion or more—are projected to make their public debut. This hopeful prospect arises from insights gathered by PitchBook in their Venture Monitor report for the fourth quarter of 2024. The report indicates that while the industry shows signs of growth, underlying challenges could affect the actualization of public offerings.

Unicorns have been a fascinating aspect of the entrepreneurial ecosystem, representing both innovation and the potential for substantial returns on investment. However, the pathway to going public is fraught with challenges, particularly in an economic climate where valuations fluctuate and investor appetites evolve. PitchBook’s exit predictor tool applies machine learning to analyze a multitude of variables such as funding rounds, market conditions, and investor behavior to assess a startup’s potential for a successful exit—whether through acquisition or an IPO.

This predictive framework aids in creating a more nuanced understanding of ventures’ trajectories, going beyond simple valuation figures. It allows investors and stakeholders to strategically position themselves when contemplating future investments or exits. Notably, the report highlights the complex landscape of prevailing economic conditions which could lead to a renewed focus on recalibrating expectations around company valuations and funding approaches.

Despite recent increases in investment rates in venture capital, there is a noticeable disconnect between financiers’ expectations and the actual performance of startup companies. The narrative is punctuated by challenges in securing meaningful exits. Nizar Tarhuni, EVP of research and market intelligence at PitchBook, underscores that while there is a visible uptick in early-stage funding, inflated valuations hinder the prospects of sales and IPOs. Buyer-seller mismatches are becoming more commonplace, stemming from previous investor exuberance.

The atmosphere is clouded with apprehension due to regulatory headwinds, which have restricted broader deal flows. The VC industry is not just grappling with internal valuation issues but is also navigating external pressures that may put a damper on investment opportunities. However, as Tarhuni suggests, a shift in Washington’s regulatory stance could lead to a more encouraging environment for mergers and acquisitions, thus reigniting the exit landscape.

Capturing the sentiment of cautious optimism, Bobby Franklin, CEO of the National Venture Capital Association (NVCA), expresses that transformative changes in regulatory frameworks could ameliorate existing liquidity challenges for venture-backed companies. With fresh leadership at regulatory agencies, there is potential for policies that facilitate innovation and support sustainable growth.

One of the crucial areas to watch is the tax bill currently in Congress, which aims to renew incentives for research and development and correlate with the broader ideals of fostering a competitive American economy. Increased collaboration between venture capitalists and government officials could pave the way for policies that truly benefit the venture ecosystem.

Within the emerging pool of unicorns likely to IPO, companies like Anduril, a defense technology firm, and Mythical Games, which specializes in Web3 gaming, stand out with projected probabilities of 97% for a public offering in 2025. Other notable names with significant chances of entering the public market include Impossible Foods and SpaceX, underscoring a trend where deep-tech and gaming companies lead the charge toward IPOs.

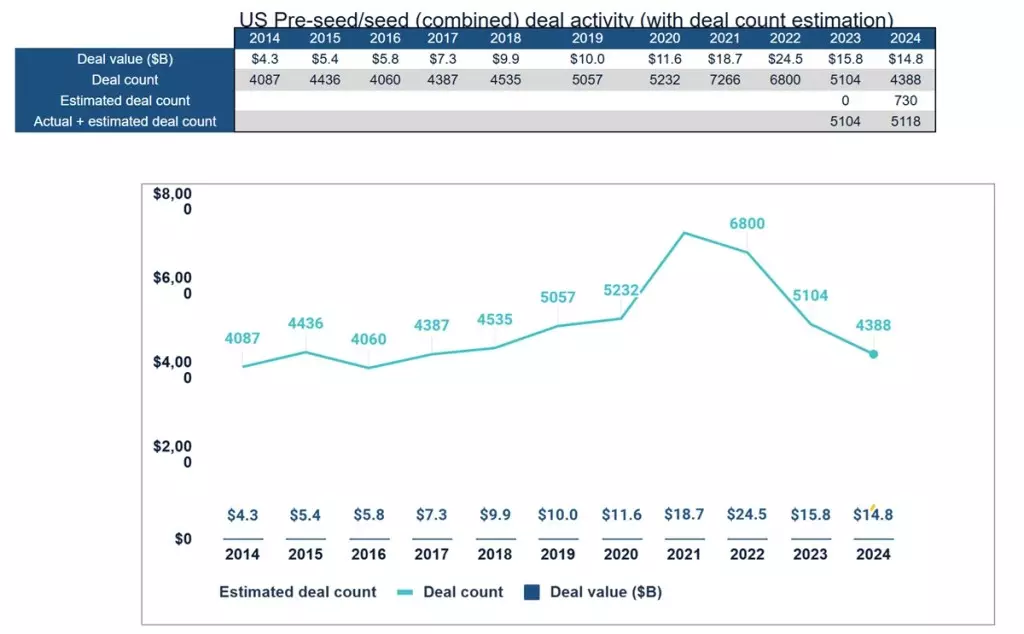

Interestingly, data indicates a decrease in startups raising between $1 million and $5 million in 2024, contrasting sharply with peaks in previous years. This trend could signify a contraction in the early-stage market, which may ultimately impact the long-term strategy for scaling and exiting.

While the outlook for U.S. unicorn IPOs in 2025 harbors a thread of optimism, it is crucial to remain aware of the multifaceted challenges that lie within the venture capital ecosystem. Stakeholders must navigate these waters with an eye on regulatory trends and financial realities to truly capitalize on the forthcoming opportunities. The importance of recalibrating expectations cannot be overstated as the industry anticipates a potentially transformative year ahead.